Resources for Student Employees

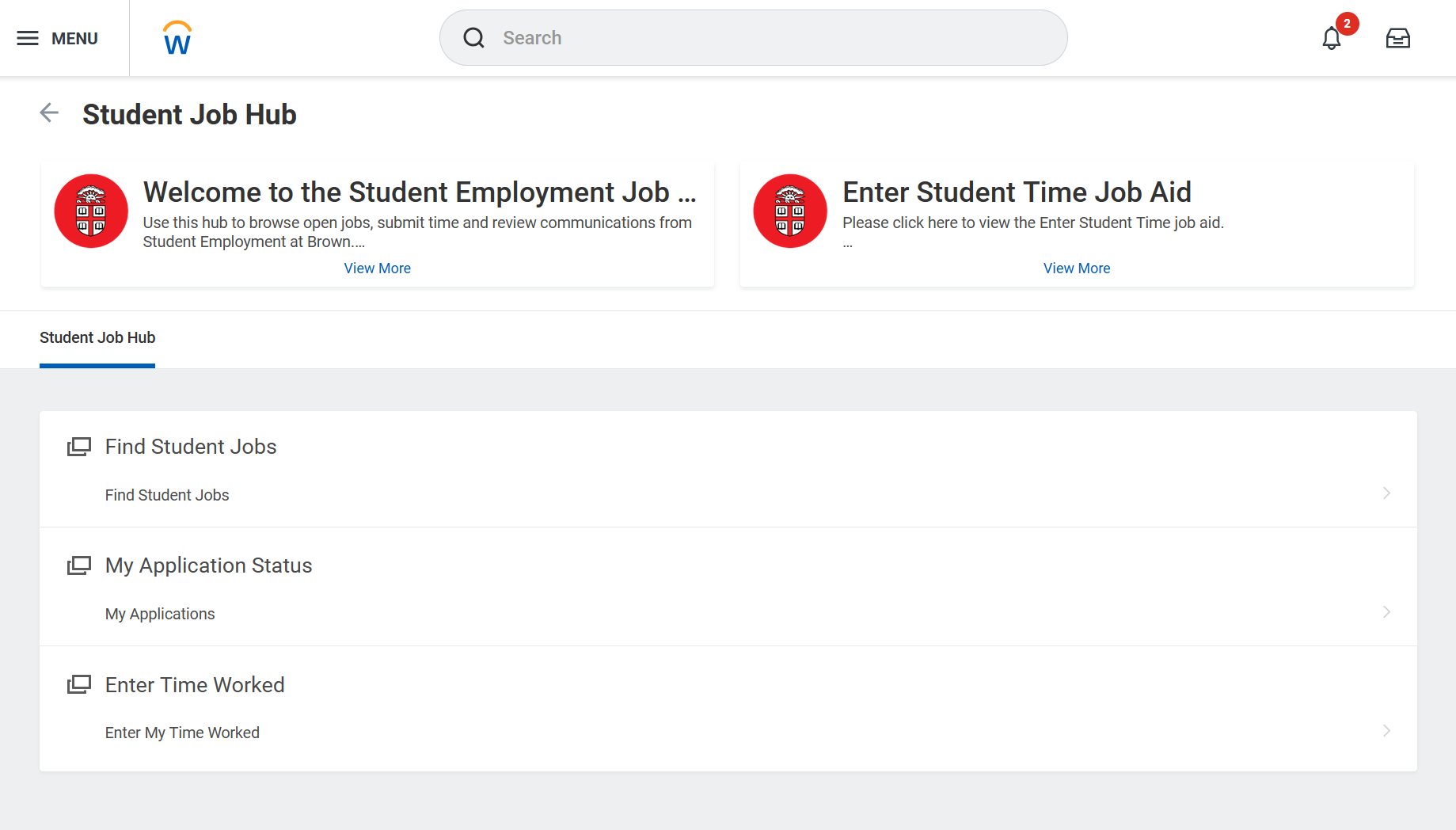

Student Employment Job Hub

One stop for undergraduate student workers to manage their jobs in Workday at Brown University

From the overview screen, students can:

- Browse and apply for student jobs

- View and manage applications

- Enter and submit time worked

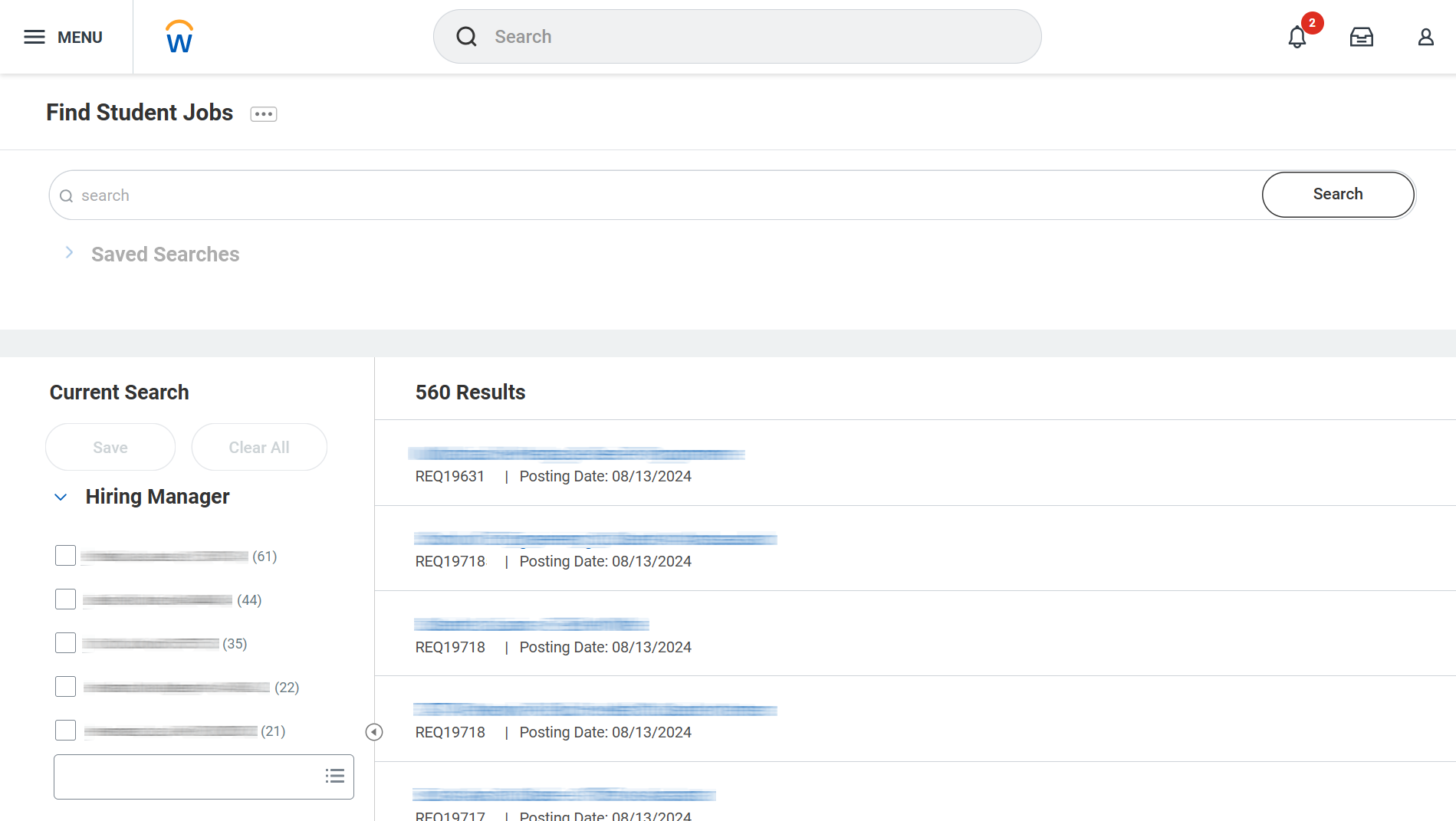

Search for open positions at Brown using filters to narrow preferences (i.e. job profile, department, work location and time type).

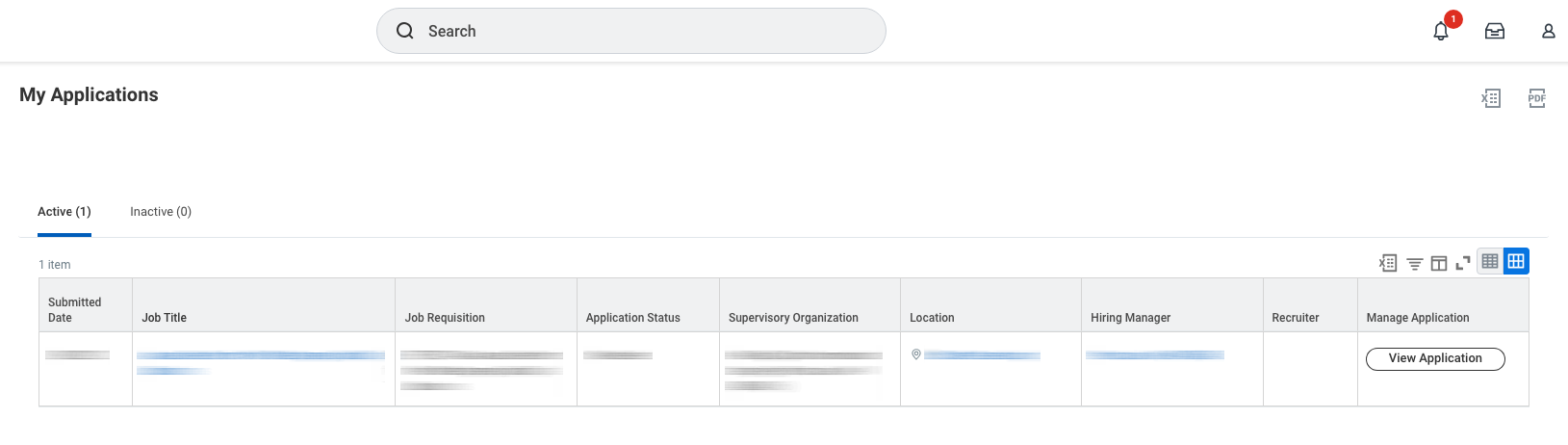

Centrally view application status for all positions.

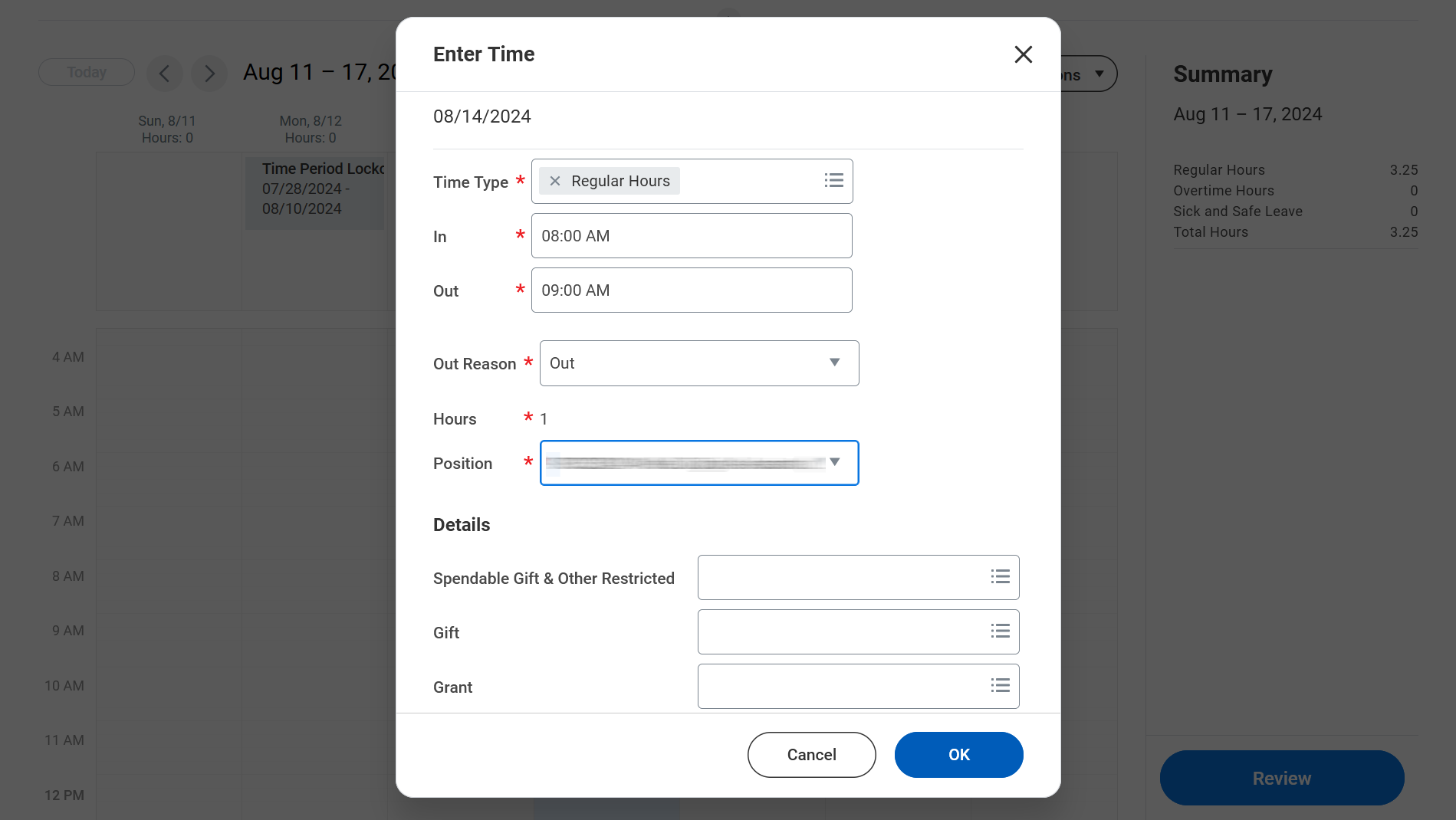

Enter hours worked each week for on-time and accurate payments. Contact your manager with questions about time entry.

Additional Resources

Direct Deposit

It is not required; however, employees are encouraged to sign up for direct deposit so timely payments are received. Students who do not set up direct deposit will receive paper checks delivered to their campus mailbox.

Resources for International Student Employees

The Office of International Student and Scholar Services (OISSS) provides information about a wide range of topics useful to incoming international students and scholars, both before and after their arrival in the United States.